Real Estate Agents: Have you set up a corporation and are you compliant with the Corporate Transparency Act?

By Admin February 27, 2024 Category: Real Estate Tags: Asset Protection Business Structure chase law manhattan beach Corporate Setup Corporate Transparency Act deanne chase entrepreneurship Financial Security Law Firm Legal Compliance Legal Insight los angeles attorney Real Estate Agents Real Estate Corporations Real Estate Industry Risk Management small business Wealth Management

Benefits of Having a Corporation

In the real estate industry, there are many complexities of legal and financial matters involved in property transactions. Establishing a corporate structure provides real estate agents numerous advantages, ranging from tax benefits to liability protection. By operating through a corporation, agents can potentially reduce tax burden and shield personal assets from business-related liabilities, providing invaluable peace of mind in an inherently risk-laden industry.

Without setting up a corporation, real estate agents operate as sole proprietors or in partnerships, exposing themselves to significant risks. They may face personal liability for business debts, lawsuits, or legal claims arising from transactions or property issues. Furthermore, without the legal separation provided by a corporation, their personal assets, such as homes or savings, are vulnerable to seizure or loss in the event of litigation or bankruptcy related to their real estate activities. This lack of protection could jeopardize their financial stability and personal well-being, making it imperative for agents to establish a corporate structure for their business endeavors.

Single-shareholder Corporations

A single-shareholder corporation as the name says is a type of corporation that has only one shareholder or owner. In such a structure, a single individual holds all the shares of the corporation, effectively controlling the entire entity. This form of corporate organization is common among small businesses, freelancers, or entrepreneurs who prefer the liability protection and other benefits of a corporation while maintaining full ownership and control.

Corporate Transparency Act

For real estate agents with single-shareholder corporations, ensuring compliance with the Corporate Transparency Act is paramount. Failure to meet these reporting obligations can result in severe penalties and legal repercussions, jeopardizing the agent’s business reputation and financial stability. Therefore, it is imperative for real estate agents to be familiar with the requirements of the CTA and take proactive steps to fulfill their obligations as a corporate entity. To learn more about the act and the requirements, click here for our post about the CTA.

The Corporate Transparency Act (CTA), which came into effect on January 1, 2024, now imposes additional obligations for businesses including real estate professionals who operate under single-shareholder corporations, requiring them to disclose beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN). This means that real estate agents must comply with the beneficial ownership information reporting requirements outlined in the CTA if they have their own corporation for real estate business.

Under the CTA, beneficial ownership information includes identifying the individuals who directly or indirectly own or control 25% or more of the corporation’s ownership interests, as well as those who have significant managerial control over the entity. This information must be reported to FinCEN, enhancing transparency and combating illicit financial activities such as money laundering and terrorism financing.

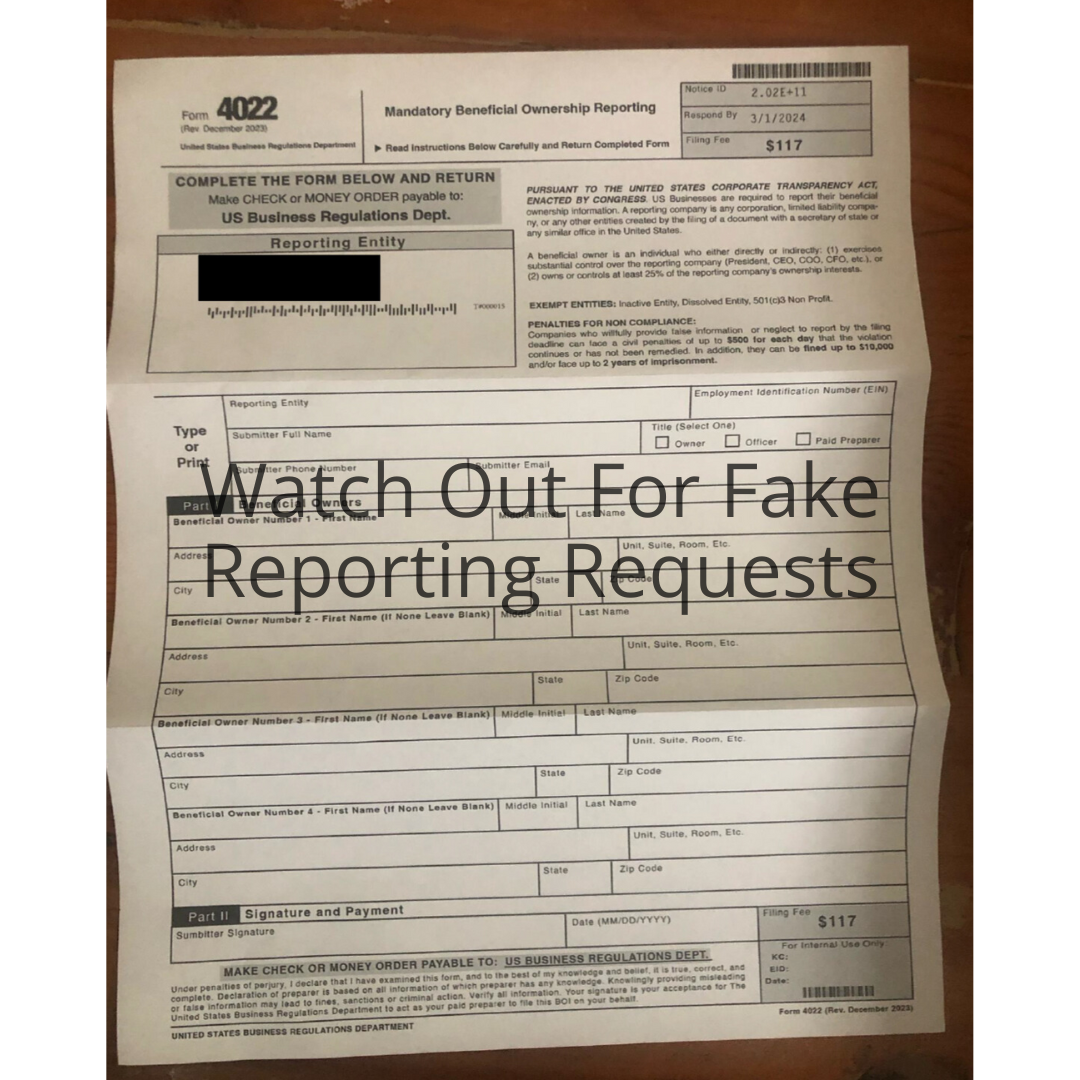

Watch Out For Fake Reporting Requests

In light of the recent Corporate Transparency Act, it’s crucial to remain vigilant against look-alike spam or scam attempts masquerading as official forms. (See example below.) With opportunities for confusion heightened, it’s prudent to verify any suspicious correspondence with an attorney before disclosing sensitive information to ensure business and personal data are protected from potential exploitation. Feel free to contact Chase Law Group if you have received a questionable form or if you’re just unsure.

Conclusion

While navigating the complexities of the Corporate Transparency Act may seem daunting, it presents an opportunity for real estate agents to demonstrate their commitment to transparency and accountability. By understanding the implications of the CTA and ensuring compliance within the single-shareholder corporation, agents can safeguard their business interests and maintain trust with clients and stakeholders in the real estate market.

Ready to safeguard your assets and protect your business? Contact Chase Law Group today or give us a call at 310-545-7700 to set up your corporation and navigate the Corporate Transparency Act with confidence.