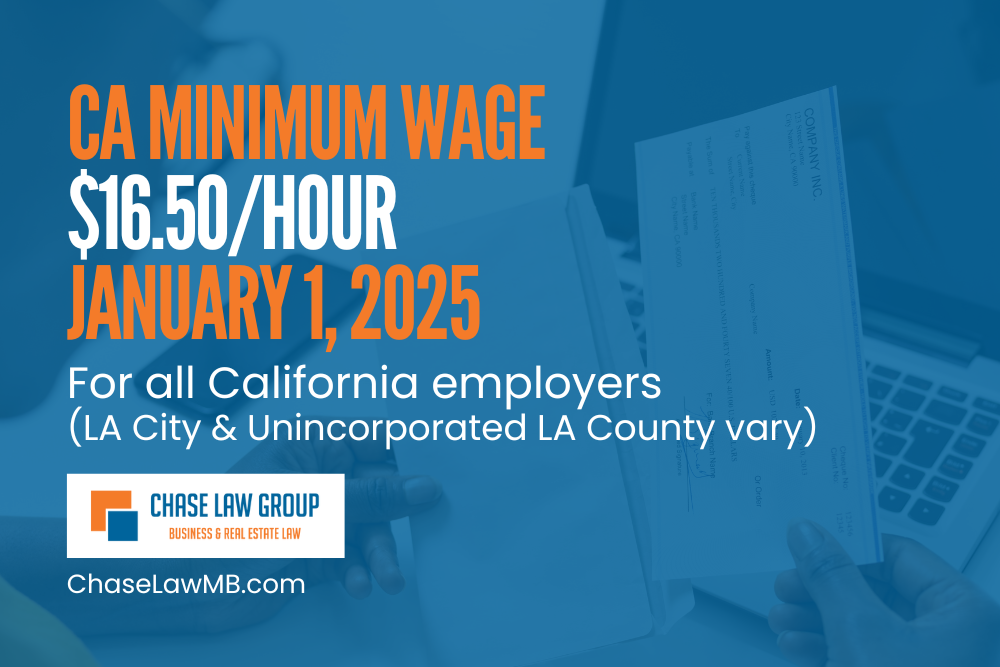

California Minimum Wage Set to Increase Effective January 1, 2025

By Admin December 02, 2024 Category: Employment

Although Prop 32, which would have increased California minimum wage to $17.00 for smaller employers and $18.00 for larger employers narrowly failed to pass earlier this month, California minimum wage for all size employers is set to increase to $16.50 effective January 1, 2025 pursuant to already existing legislation. Additionally, as a result of this change in minimum wage, the minimum salary for exempt employees will increase to $68,640 or $5,720.00 per month. If exempt employees are not paid at least this much, they will not qualify as exempt. Also, note that minimum wage for the City of Los Angeles... READ MORE

Governor Newsom recently signed into law several new California employment laws that come into effect on January 1, 2025. Below are these new laws. Prohibition of Requiring Employees to Attend a Meeting Where Religious or Political Opinions Are To Be Discussed Under SB 399, the “California Worker Freedom from Employer Intimidation Act” (subject to limited exceptions) prohibits employers from taking or threatening to take adverse action against an employee who declines to attend a meeting or participate in, receive, or listen to its opinion on “religious” or “political” matters, which includes union organizing. Violations are subject to a civil penalty... READ MORE

As the November 5th election approaches, employers are reminded to comply with California’s voting-related laws, including leave and posting requirements. Voting Leave California employers must permit employees up to two hours of paid time off to vote if they don’t have enough time outside work hours to vote. Employers may require employees to give advance notice that they will need such time off for voting. Employers can limit the time off to be taken only at the beginning or end of the employee’s shift, whichever provides the greatest opportunity for voting and minimizes the time away from the regular work... READ MORE

What Steps Should an Employer Take When an Employee Reports a Workplace Injury?

By Admin August 27, 2024 Category: Employment

When an employee reports an injury that occurred on the job, it's crucial for employers to respond promptly and correctly. Navigating this process can be complex, particularly with the overlapping requirements of your workers' compensation insurance carrier, various types of leave, and federal and state regulations. Here’s a step-by-step guide to help you handle such situations effectively. Immediate Steps to Take Ensure Employee Safety and Medical Attention: First and foremost, ensure that the employee receives appropriate medical care. If the injury is severe, seek emergency medical services immediately. If the injury is less critical, guide the employee to a healthcare... READ MORE

Trademarks: Do I Need One? Find Out Why This Legal Tool Could Be a Game-Changer for Your Business

By Admin July 30, 2024 Category: Trademarks & Copyrights

So you’ve got a brilliant idea and a fantastic business name. But have you ever stopped to think about protecting that name and the unique brand you're building? Enter trademarks—a legal powerhouse that can safeguard your business’s identity. If you’re wondering whether a trademark is necessary for your venture, here’s a sneak peek into why it might be a game-changer for your business. What is a Trademark? In a nutshell, a trademark is a distinctive sign or symbol used to identify your goods or services and distinguish them from those of competitors. It could be a word, phrase, logo, symbol,... READ MORE

California’s Indoor Heat Regulations To Take Effect August 2024

By Admin July 30, 2024 Category: Employment

Starting August 1, 2024, California employers will be required to monitor indoor heat for workers and take steps to reduce the temperature in the workplace and make accommodations for employees. While this new regulation applies to virtually all companies, employers with workers in restaurants and warehouses should take particular attention to these new requirements. The new law is focused on the risk of health illness to employees.The new rule will generally require employers to cool indoor workplaces that reach or exceed 82 degrees Fahrenheit whenever employees are present. When the indoor temperature reaches 82 degrees, employers must do the following:... READ MORE

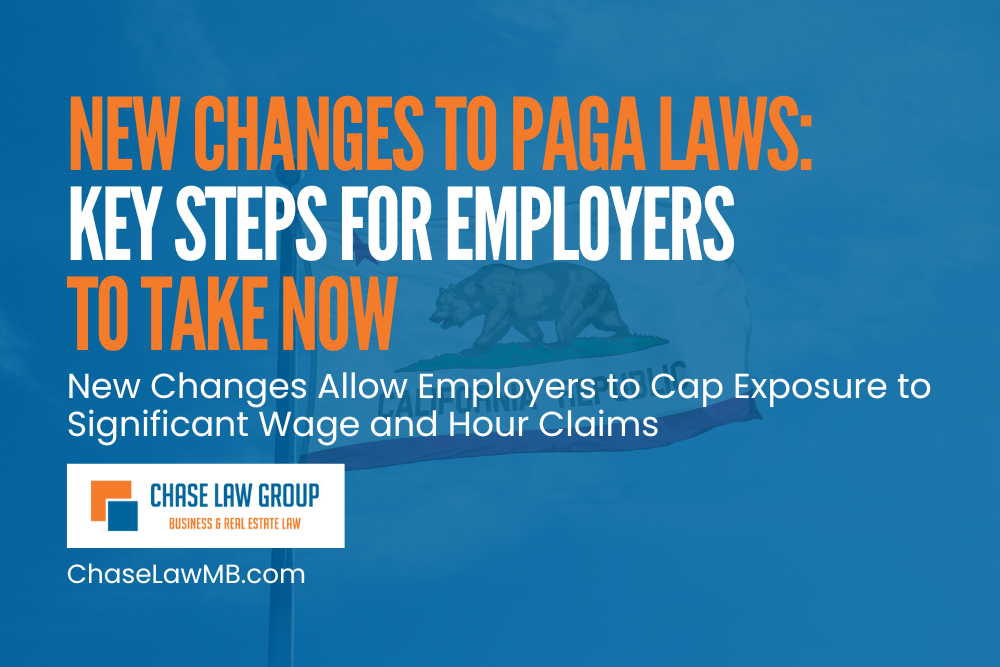

New Changes To PAGA Laws: Key Steps For Employers To Take Now

By Admin July 24, 2024 Category: Employment

After years of attempts by employer groups to repeal or make common sense changes to PAGA (Private Attorneys General Act) laws, on July 1, Governor Newsom signed Assembly Bill 2288 and Senate Bill 92 which reflect significant reforms to the Labor Code Private Attorneys General Act of 2004. The new changes to PAGA give employers a lifeline when it comes to wage and hour exposure by implementing new changes to the law that give employers the ability to avoid and reduce potential exposure under PAGA. The following sets forth the key changes in the law. 1. What is PAGA (Private... READ MORE

Legal Considerations for Distinguishing Between a Hobby and a Business Understanding whether your side hustle qualifies as a hobby or a business goes beyond just tax implications; it involves significant legal considerations. This distinction affects how you operate, your financial obligations, and potential liabilities. Differentiating Between Hobby and Business The primary distinction between a hobby and a business lies in their objectives. A business is conducted with the intention of making a profit, while a hobby is pursued for personal enjoyment without the intent to generate income as a primary objective. This differentiation is vital because it affects the side... READ MORE

Important Developments in California Employment Law Effective July 1, 2024

By Admin June 27, 2024 Category: Employment

Starting July 1, 2024, California employers must comply with the following changes in the law impacting their employees: 1. Most Employers Must Implement a Workplace Violence Prevention Plan As previously explained in last month’s newsletter, California requires employers, with few exceptions, to implement a Workplace Violence Prevention Plan (WVPP) by July 1, 2024. Details of the WVPP and how to comply with the new requirements can be reviewed by clicking here. Should your company need assistance in creating a WVPP, Chase Law Group can assist you. Contact us to get started. 2. Changes in the Division of Workers Compensation New... READ MORE

It’s Time for Summer Vacation: Be Prepared for Employee Requests for Time Off

By Admin May 29, 2024 Category: Employment

With summer fast approaching, it’s a good time to review and update company vacation and personal time off (PTO) policies to ensure compliance with California law. The following is a brief discussion of the laws that apply to vacation and PTO in California. Vacation versus PTO Policy As a preliminary matter, employers are not required to have a vacation or PTO policy. However, once they do have such a policy, employers must comply with applicable California requirements. There are two approaches when it comes to providing paid time off to employees. Some employers elect to provide a stand-alone vacation policy... READ MORE